Post Office RD Interest Rate. GSB have a 30 month fixed account paying 183 no tax deducted.

5 Key Facts You Probably Didn T Know About Tax Deductibles In Malaysia

PPF interest rate is currently compounded at 71 annually.

. Pos Malaysia dan commercial banks appointed as IBRM collection agents. In general expenses incurred for the production of business income are tax deductible. This enables a business enterprise to issue the bonds at a lower interest rate.

Monthly Tax Deduction MTD 25. Interest payable for nonpayment of tax by domestic companies. Payment of Compound Under Labuan Business Activity Tax LBATA 25.

The PPF interest rate has remained constant since April 2020 till date at 71. Open to non Thais but no joint accounts. A credit for a specific foreign tax for which foreign tax credit would not be allowed by the Internal Revenue Code.

LUMP-SUM TAXATION -- The tax laws of some countries allow the tax authorities to levy a fixed amount of taxes on income in certain circumstances which deviates from. Real property interest based on a treaty. Eg not limited-scope dentalvision health FSA fixed indemnity.

INTEREST Applicant or representative MM2H company must be present. With no other income you would need 10M on deposit before you pay tax on the interest. Unlike the resident Indians NRI investors are not eligible to benefit from the basic exemption limit.

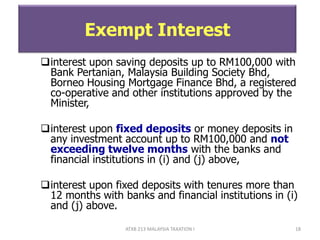

Interest income received on certain qualified private activity bonds generally is exempt from federal income tax. The interest rate for the final six months is 5 so closing before maturity would not be prudent. Interest under Section 234B and Section 234C is applicable when you dont pay your advance tax.

Read todays most read article on London Stock Exchange and browse the most popular articles to stay informed on all the top news of today. To avoid Interest Penalty under Section 234B and 234C Pay advance tax when your tax liability in a year is Rs. Interest payable for nonpayment of tax by company.

Post offices are popular in Indian and the main reason is it provides services more than posting mails. A change to the source of an item of income or a deduction based on a treaty. Whether it is a life insurance product or small savings schemes post offices offer many savings alternatives for working-class people.

Tax on distributed income to unit holders. The exemption applies to a US. Health and education cess chargeable at the rate of 4 will be applicable over and above the given income tax rates and surcharge.

Interest is credited on the deposit by the Inland Revenue. The plan provides coverage. All application for withdrawal of fixed deposit is no longer permitted to be submitted by e-mail.

Personal income tax relief letter from Inland Revenue Board of Malaysia LHDN-salary above RM1000000. Interest payable for nonpayment of tax. Any redemption made by an NRI is subject to TDS at the highest tax rates.

Audit Instalment RPGT Payment. Payment for Increase Under Section 13 LBATA. This is equivalent to 215 before tax.

Capital expense on prescribed fixed assets subject to limitations and environmental protection machinery. Automated Teller Machine ATM of selected commercial banks. How to pay NRI capital gains tax.

Payment of Labuan Business Activity Tax Assessment Fixed Rate RM2000000 23. ICash Deposit Machine CDM of several commercial banks. Out of all the other traditional fixed deposits and long-term savings schemes provided by Post offices- recurring.

When company is deemed to be assessee in default. A reduction or modification in the taxation of gain or loss from the disposition of a US. Payment of Labuan Business Activity Tax Assessment 3 on Chargeable Income 24.

Advance tax payments done until 31st March of the year should be 100 of your total tax payable. Citizen who has a tax home main place of work or employment or if you dont have a main place of work or employment your main residence in a foreign country and is a bona fide resident of a foreign country. Payment for LBATA Assessment 24 of Business.

The Act preserves this exemption but repeals the interest exemption for advance refunding bonds issued after 2017. Any incomplete documents will not be processed. While the fixed deposit interest rates do not vary the interest rate for the PPF deposits varies for each consecutive year.

However according to the Inland Revenue Department of Hong Kong the following expenses are not tax deductible. Interest on Judgment - RPGT Payment. Tax on distributed income to shareholders.

The portfolio interest exemption does not apply to bank loans made in the ordinary course of business. The interest rates for the PPF deposits are not like those of FDs or Fixed Deposits.

Crypto Tax Free Countries 2022 Koinly

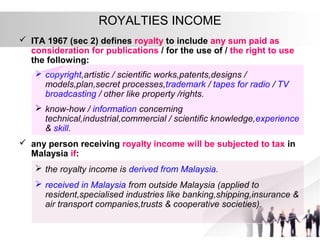

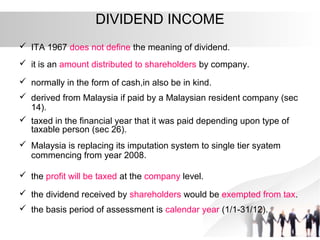

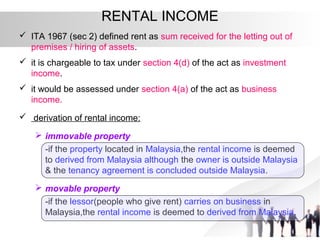

Taxation Principles Dividend Interest Rental Royalty And Other So

Taxes In Malaysia Including Mm2h Entrepreneur Visas Penang And Labuan November 10th 2021 Htj Tax

Taxation Principles Dividend Interest Rental Royalty And Other So

Chapter 5 Non Business Income Students

Taxation Principles Dividend Interest Rental Royalty And Other So

Malaysia Personal Income Tax Guide 2021 Ya 2020

What Is Neft First Bank Stock Market Online Banking

In The Matter Of Interest Crowe Malaysia Plt

Tax And Investments In Malaysia Crowe Malaysia Plt

Taxation Principles Dividend Interest Rental Royalty And Other So

Malaysia Personal Income Tax Guide 2021 Ya 2020

Everything You Should Claim For Income Tax Relief Malaysia 2021 Ya 2020

Personal Income Tax Interest Income Tax Treatment

5 Key Facts You Probably Didn T Know About Tax Deductibles In Malaysia

Rental Income Tax Malaysia And Other Tax Reliefs For Ya 2021

Taxation Principles Dividend Interest Rental Royalty And Other So

Rental Income Tax Malaysia And Other Tax Reliefs For Ya 2021